ETHIO BIRHAN TRADING

Company Profile

Address

Addis Ababa| Ethiopia

Bole Sub City Woreda 5

Wazema Building, 4th floor

P.O.BOX 25400 A.A | Ethiopia

Postal code 25400/1000

Telephone +251118674264

Fax +251116687088

Website: https://ethiobirhan.com

Email: Info@ethiobiran.com

ETHIO BIRHAN TRADING

Company Profile

Ethiobirhan trading was established in 2017 with the initial name of MS Trading was working on steels trade. In 2020 the company legal status has been upgraded and expand to private company under the official name of Ethio birhan trading which is now working mainly on importing solar energy equipment’s (solar palates, solar batteries, solar power inverters, energy efficient lights, solar pumps), solar water heaters, rechargeable batteries and exporting different seeds including Kidney beans (white, red, Haricot), Humeras and wollegas Sesame seeds, Coffee and Bamboos to the world market. Our company has moved to its new workplace at around 24 wazema building 4 floor.

Visions

Ethio birhan trading would like to see itself as one of the leading companies in Ethiopia. We seek to be the premier organization with ability of supplying all kinds of our products & materials with our own logistics worldwide and giving a better solar power system installation services staring with surveying through design, installation, supervision and maintenance. Taking care of the interests of our customers which we consider as our business partners and provide the highest quality, service and products besides catching our own growth targets.

Missions

Our mission is to make difference in our products and services, to keep in the forefront the satisfaction and trust of our customers and manufacturing companies and to move forward with our new products and service. Provide fast services and assure on time delivery.

And to be competitive in off grid solar power applications include home and institutional lighting, mobile charging, running audio-visual equipment, in health facilities, water pumping, and powering telecom stations. And being the top ranked company in import and export trading.

Objectives of the company

- Importing and supplying solar energy equipment’s to alleviate the problem of a society with a shortage of electricity supply, minimize energy cost and environmentally friendly.

- Exporting different seeds and Bamboo’s for the world market.

- To establish ethio birhan trading plc. As the number one importer and exporter of the products.

- To Increase the number of solar energy supplies being carried in local markets to satisfy that market segment that demands the solar energy.

Business and Industry Profile

Stage of growth

The solar electrification companies of Ethiopia at present are at an infant stage. It is in introductory stage but consciousness as well as needs of people is increasing at a good rate and the existing companies are getting popular among upper class of residents. For this reason, the popularity and the use of renewable energy demand is increasing. Our Company Ethio birhan trading as competitive marketer and service provider we have done different projects for residential customer, large organizations, industries and apartments on solar power installation with higher qualities, appropriate prices by our experienced engineers.

And we are experienced on exporting of the seeds: – Kidney beans (white, red, Haricot), Humeras Sesame seeds, Coffee and Bamboos for the external worlds with greater quality and appropriate price.

Product and services

Our company imports different type’s products: –

Solar panels

- Solar power invertors ( Single phase and three phase)

- Charge Controller

- Solar batteries

- Combiner box

- Rechargeable batteries

- PV cable

- Battery cable

- Solar Boiler ( Solar water heater)

- Energy efficient light

Our company exports the following products:-

- Kidney beans (white, red, Haricot),

- Humeras Sesame seeds,

- Coffee and Bamboos

- Different steel product

Our company also exports different type’s seeds and Bambos: – Our Company gives services for our customers with high quality and good price.

Solar Panel

Solar Power Invertor

Charge Controller

Solar PV cables

Solar Batteries

Solar Water Heater

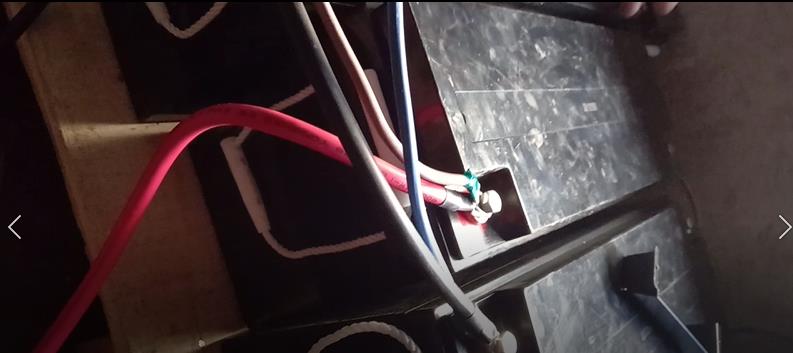

Solar Power Installation

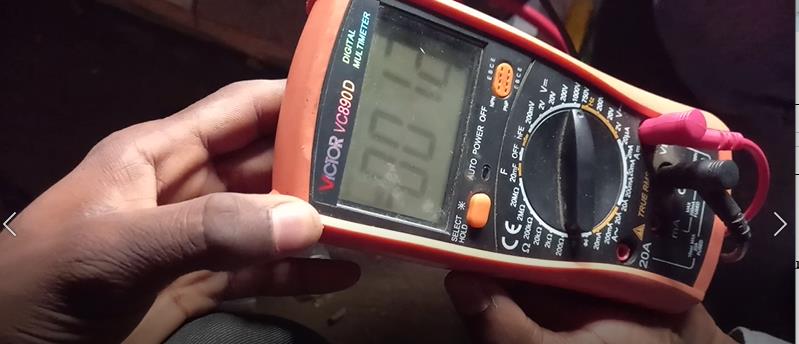

Rechargeable Battery

Smart Flower Solar

White Kidney Beans

Red Kidney Beans

Haricot Kidney Beans

Sesame Seed

Coffee

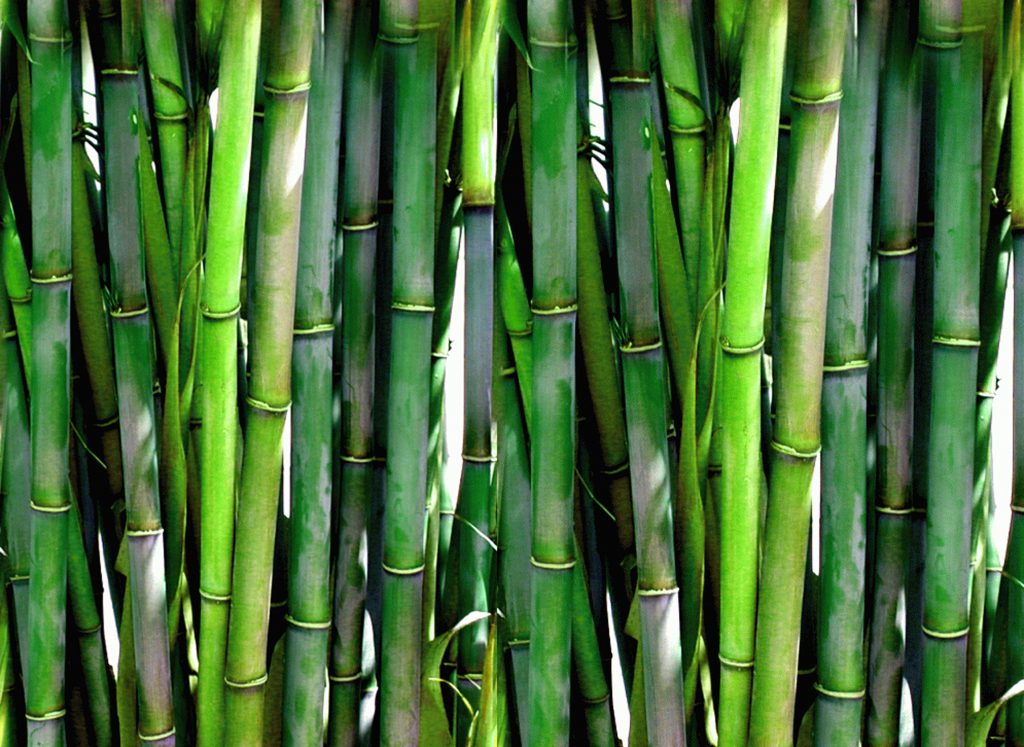

Bamboo

Steel Products

Imported products

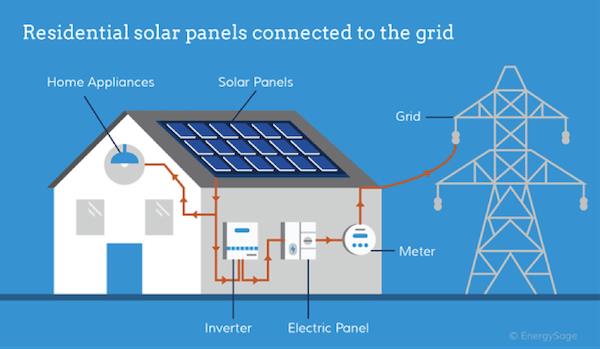

- Solar Panel – PV collect energy from the sun in the form of sunlight and convert it into electricity. It can be used to power homes or commercial.

- Has life expectancy of 25-30 years.

- Rating range 275w, 300w, 325w, 350,450w……

- 3 types of solar panel (Monocrystalline, polycrystalline and thin film solar panels).

2. Solar power invertor – the main purpose of the solar inverter is to translate or invert the solar energy generated by your solar panels from dc to ac so that your home and utility grid can use it.

Types of invertor

- Micro inverter

- Battery based inverter

- String inverter/ Central inverter

- Hybrid inverter

- Optimizer

3. Charge controller

- It prevents overcharging and may protect against over voltage.

- 2 different charge controllers( PWM- pulse width modulation and MPPT- maximum power point tracking)

4. Solar Battery

- store the energy generated from the solar panels for later use.

- the expected life time of lithium ion batteries is around 10s years.

- Lithium ion : can charge within 2 hours , portable , maintenance free , less memory effect , high efficiency , reliable , stable , long lasting power , high power capacity , have lifespan of over 10 years , can handle more than 2000 times of charge and discharge cycle

5. Solar Water heater

- fully powered by solar energy.

- They collect most of the sun’s rays when the sun is in the brightest light and store the excess hot water for later use.

6. Rechargeable battery

- much lighter than other types of rechargeable batteries.

- They hold their charge.

- They have no memory effect.

- Life of a lithium ion rechargeable battery about 2 to 7 years

7. Smart flower

is a fusion between solar panels, art and the dual axis tracking system, the flower panel reliably tracks the sun throughout the day – producing upwards of 40 percent more clean energy than traditional solar panels. At sunset, the petals automatically retract until the next morning.

- Ground-mounted solar panel systems that include a sun tracker and a number of other high-tech features. This ‘smart‘ solar panel system is an all-in-one, self-sustaining system

Industry and Market Place Analysis

One third of the world’s population has no electricity. The majority of these people live in rural, remote areas of the world’s poorest nations. In the past ten years, global electricity demand has grown by 40 percent. During this time, the use of renewable energy has expanded at ten times the rate of fossil fuels. Experts predict that the world’s electricity demand could triple by 2040, a colossal increase that will be fuelled by the industrialization of developing countries. As a specialty provider and integrator of renewable energy systems designed for developing communities, Ethiopia will position itself to capitalize on this explosive renewable energy sector.

Ethiopia is one of the least developed countries in the world. Approximately 34% of its over 100 million inhabitants live below poverty line. It has one of the lowest rates of access to modern energy services, whereby the energy supply is primarily based on biomass. With a share of 92.4% of Ethiopia’s energy supply, waste and biomass are the country’s primary energy sources, followed by oil (5.7%) and hydro power.

Most of the energy needs of Ethiopia are filled by bio fuels for cooking, heating, and off-grid lighting. Petroleum, including gasoline, diesel and kerosene supply less than 7% of the country’s energy supply. Solar photovoltaic is being promoted to replace fuel-based lighting and off-grid electrical supply with a solar panel assembly plant opening in Addis Ababa in early 2013. The majority of the Ethiopia’s population live in rural areas and very few have access to electricity.

This aim was set through their ambitious three-stage Growth and Transformation Plan, Ethiopia seeks to transform itself into a modern economy by 2025. According to the Ministry of Water and Energy, as of 2018, only 23%of the national population has access to grid electricity. That figure falls even further to 10% when moving to rural areas – a figure that’s smaller than the 17% average found across the rest of Africa. Drought frequency, flooding, poor land management techniques, and a rapidly growing population all have increased the situations direness.

Key success factors in the industry

Load shedding it has become a huge burden on the life style of urban people. People need other sources of energy to do their jobs as well as for recreation. Also, load shedding problem is forecasted to continue and grow till the next 10 years. So sooner or later, people will search for alternative sources.

Renewable source of energy: Solar energy is renewable source of energy and due to this reason customers are not burdened by any running cost. Once they install the system, they get energy for their lifetime without having to pay any penny.

Pollution free energy: Photovoltaic (PV) modules (Solar Panels) gives free and environment friendly electric power whenever we want it. PV modules generate electricity directly from sunlight and their operation is completely noise and pollution free. Because they have no moving parts to wear and tear,they will provide reliable power for decades.

There are five main renewable and alternative fuels.

- Wind power is created when wind spins a turbine, or a windmill, which can be located on land or offshore.

- Solar power harnesses the sun’s energy in two ways: by converting the sun’s light directly into electricity when the sun is out (think solar panels), or solar thermal energy, which uses the sun’s heat to create electricity, a method that works even when the sun is down.

- Hydropower is created when rapidly flowing water turns turbines inside a dam, generating electricity.

- Nuclear energy is produced at power plants by the process of nuclear fission. The energy created during nuclear reactions is harnessed to produce electricity.

- Biofuels, also referred to as biomass, are produced using organic materials (wood, agricultural crops and waste, food waste, and animal manure) that contain stored energy from the sun. Humans have used biomass since they discovered how to burn wood to make fire. Liquid biofuels, such as ethanol, also release chemical energy in the form of heat.

Ethiopia has ambitious plans for renewable energy. Since 2017, Enel Green Power has been working alongside the Addis Ababa government to support sustainable development and the energy transition. The future of Ethiopia depends on the sun that lights its highlands, the wind that blows through its forests and the force of its rivers. The country is rich in sources of renewable energy. If taken advantage of, they can help build a sustainable tomorrow. The Growth and Transformation Plan involves the construction of 13.7 GW of new renewable capacity from sources other than hydroelectric in the coming years, in order to diversify the Ethiopian energy generation mix.

Through Scaling Solar, a program sponsored by the World Bank that provides financial assistance to emerging countries for solar energy, it launched its first public tenders for the construction of new photovoltaic plants. Ethiopia is the fourth country, after Madagascar, Zambia and Senegal, to opt for Scaling Solar. With the program, it aims to build 500 MW of solar energy, enough power to eliminate its energy deficit.

Today, 60 million Ethiopians still don’t have direct access to electricity. Access to clean energy is the key to the development of Africa. For a secure and sustainable energy future, renewable sources are the answer. The cost competitiveness, the availability of resources and the fast time to market of green technologies can contribute to the spread of energy sustainable in Africa.

The current Prime Minister Abiy Ahmed, in office since May 2018, has carried on the green commitment of his predecessors. Because of this, and a stable regulatory framework based on tenders and PPAs, Ethiopia has the potential to speed up its journey toward sustainable development and overcome the many contradictions still present.

Ethiopia has a large off-grid rural power market, equivalent to the combined off-grid market of countries in East Africa. Ethiopia is singular in the opportunities to address its own as well as regional markets through renewable energy due to good renewable resources, rapidly growing incomes, its green economy strategy, and its growing educated and trained workforce. Solar electricity has the potential to address major development goals in rural areas in the health, education, and information sectors. The size of demand and growing manufacturing capability opens potential to create a domestic solar energy industry.

- A large dispersed rural population: Eighty percent of the population or 65 million Ethiopians live in rural areas. Addressing demand for energy services for this population is a challenge; but it is also an opportunity to meet it through distributed renewable energy services including solar electricity.

- The fastest growing, non-oil-exporting, economy in Africa: Ethiopia grew at more than 8% annually for the past six years, twice as fast as the African average. This increases domestic financial and technical capability and opens opportunities to mobilize consumer, private and public resources.

- One of the few green economy strategies in the world: Ethiopia has one of the few green economy strategies in the world and only the second in Africa. This creates opportunities to attract resources, domestic and external, for green programs in Ethiopia.

- Rapidly growing educated and trained workforce. The pool of engineers and technicians has rapidly increased in Ethiopia over the past decade.

There is also need to integrate this vision and strategy with the industry strategy. There is obvious desire to make Ethiopia the regional renewable energy leader (stated in the sector Strategic Plan). But this desire is not backed by adequate industry (for renewables) level strategies and actions, sector institutions are also not effective. There is need for long-term outlook, specific strategies for renewables, implementation of plans without losing focus of goals, learning from experience, incorporating flexibility where needed.

Solar electricity has clear advantages in accessibility, cost and reliability compared to traditional means of rural electrification. In the mid to long term solar electricity will also be competitive on the grid. The relative benefits of solar power compared to the traditional alternatives are increasing because of rapidly declining costs, improving quality and reliability, and proven models of technology diffusion.

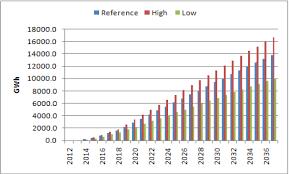

Our Solar power installation market place in Ethiopia broadly divided into three: Telecom, government, NGOs, and private driven company. The outlook for the solar electricity sector in Ethiopia is for rapid increase in installation for off-grid applications and later for grid connected applications. Off-grid applications will be dominant in the short term but grid connected PV may become important in the medium and long term.

Off-grid residential applications will be an important segment of the demand for solar power in the medium to long term. The demand for this segment of the market will be mainly private sector driven and will depend on policies and regulations in place. Existing government plans for million solar lanterns and home systems is expected to spur rapid growth increasing installed capacity by tenfold in the next five years. Off-grid institutional applications will also be important in the short term.

Off-grid telecom applications now account for 87% of the total installed PV capacity in Ethiopia. Strong growth is foreseen in the coming ten years for this segment due to the drive for universal access to mobile connectivity (the plan is for 90% mobile network coverage and for 40million mobile users by 2015). This will result in doubling of installed PV capacity by 2015 then again doubling in future. This will be public sector driven demand and is highly likely to be realize.

Off grid solar power applications include home and institutional lighting, mobile charging, running audio-visual equipment, refrigeration and diagnostic equipment in health facilities, water pumping, and powering telecom stations. Off grid PV systems range in size from the smallest 1Wp solar lantern to a village micro grid serving several hundred households and institutions.

We are dedicated solar professionals committed to bring solar electricity to the whole of Ethiopia. Solar water pumping. Solar fridges for medical food and off-grid.

Competition and marketing Strategy

There are many companies which are directly and indirectly related to our business. Some of companies focus toward rural areas and associated with government, so they are not head to head competitors. The remaining are companies which focuses on large organization and residents in the urban. Since our company will be in large scale, we will adopt cost leadership marketing strategy. To promote our company different media like Advertisement media, newspapers, Business magazines and Internet will be used. Besides we’ll be focusing on increasing the publicity of our business through activities like: sponsoring in public Medias, organizing campaign, supporting green energy program. Our company will provide flexible service to our customers in financial context by providing installment facilities. Since our company will provide small to large scale solar power installation, it will attract more customers with different potential. Our company’s web page will provide guidance and instruction to customer regarding our product and services which will make easy access to our company.

Development Strategy

Solar project development

- As part of the clean energy economy, solar-project developers are responsible for all aspects of solar energy project development, including; securing land rights, interconnection rights, building permits and property tax agreements, working closely with engineering, finance and commercial teams when a project moves ….

Advantages of solar energy

- Renewable energy source

- Reduce electricity bills

- Diverse application

- Low maintenance cost

- Technology development

- Low running Cost

Here are some of the best ways to build power and make a difference in your community?

- Stand with local organizations building the movement for inclusive clean energy.

- Support local businesses that use solar energy.

- Inform friends and neighbors about their solar options.

- To be concerned on different government sectors ( Telecom center , health sectors , and industries )

We want to create long term value for our customers and shareholders. Our very simple strategy is to generate profitable growth. Our business may be interested in energy conservation and solar energy opportunities for a number of reasons.

When evaluating if a solar photovoltaic project may be right for organizations, there are many variables that will need to be considered. For this reason, it helps to work with an unbiased solar energy company to help make decisions about our solar project. Power management will help us to understand customer’s solar technology choices, locating your solar pv array and coordinating how it will be installed and maintained. Furthermore, we will develop a turn-key solar plan, seek funding opportunities, provide insight on state and federal tax incentives available and ensure our solar project is a success.

A solar power related business including

- Solar installation business – installation of the entire solar system.

- Solar sales business – importing different solar energy based equipment’s

- Solar system maintenance business

Customer’s Motivational Factors

The concept of solar energy is not new among the Ethiopian customers. According to our market survey, most of our targeted customers are familiar with solar power installation and their benefits. Majority of customers have positive thinking towards our business idea. We have summarized some factors which help to motivate the customers to use our services. The significant customer’s motivational factors are:

1. Better alternative source of energy In the long run, solar electricity is cheaper than buying it from the power company. There is a startup cost, but then it starts paying for itself. Once you break even, everything after that is profit.

2. Giving customer what they want there is a huge variety of solar panel systems available. Some can cost tens of thousands of dollars, and some cost just a couple hundred. This means customer can get into solar, with their respective financial effort.

3. Environmental aspects Solar Energy is clean, renewable (unlike gas, oil and coal) and sustainable, helping to protect our environment. It’s not affected by the supply and demand of fuel and is therefore not subjected to the ever-increasing price of gasoline.

Exported Products

1. Coffee

1.1 COFFEE PRODUCTION AND MARKETING VALUE CHAIN IN ETHIOPIA

The producers under this stage in the coffee value chain of Ethiopia include small-scale farmers, private owned farmers and state firms. The major portion inters of volume of products mobilized, value adding functions, market share and capital owned in coffee value chain of the country is under the hands of producers especially the large-scale private coffee plantations and state farms of coffee plantations. After the coffee is grown and matured, the following value adding activities in the value chain performed by those producers are collecting coffee chary and transporting to processing areas.

Coffee cherry collecting and transporting activities in Ethiopia in which except loading and unloading, mostly performed by women groups of farmers. Most of the farm products including coffee are raw in nature and need to process before consumption. This increases the cost of marketing service, which adds value and price on farm products. Under this main activity the sub tasks performed in processing the coffee are pulping, washing coffee, drying, sorting, sacking/ packing, loading, and transporting then finally unloading to the warehouse. The small scale coffee producers are always sell the red cherry coffee on their farm as it is without harvesting, drying, and hulling to the coffee collectors. However, some small-scale farmers in country grow, harvest, dry, hull and sell their dry cherry coffee to collectors (legal and illegal collectors). While, household farmers were mostly sell red cherry coffee. The large scale-private farmers and state farms harvest coffee chary and use pulping machine (dry or wet pulping machines) add more value on the coffee products. The pulped and washed coffee then exposed to sun rise in appropriate place until the coffee bean become properly dried and those foreign materials in coffee are sorted so that it will be ready grading and sacking. Therefore, most agro processing employees are women.

Packing dry coffee loading, transporting, and unloading to the warehouses transported to the final market through ECX is also value addition. While some of the large scale, private coffee producers sell their products the exporters either in Addis Ababa or to international importers.

1.2 Primary Cooperatives and Unions

The primary cooperatives in Ethiopia are important participants in the coffee value chain of the country. They produce and harvest the coffee and some of them even perform some processing activities like washing pulping, sorting and finally sell it to their respective unions. The unions process the coffee or further processing. Finally further processed were packed, transported to their warehouse and make ready for export market. Here the unions have different alternatives to sell their products. They can sell directly to the international importer or to the domestic exporter through ECX.

1.3 Exporting apparatus

After the all the coffee production and processing activities are finished, it exported to the international market by exporters. Exporters found in Addis Ababa central market who received coffee from private producers, private traders and cooperative unions to sell it to the international market. These exporters bought the coffee from the central auction market through ECX. These coffee exporters do not get any coffee from the state producers, because state farm producers export coffee to foreign market by themselves. They play a significant role by searching foreign market through the linkage they have with the importers outside the country. They add a place utility to the commodity coffee. Here, the unions, the private traders and the state owned producers could also act as exporters of coffee, since they can directly sell it to the foreign importers.

Due to the above information, our company, Ethio Birhan, exports coffee buying from the union through ECX because the coffee unions contact to ECX for grading systems and to follow the rules and regulation of the government of Ethiopia which then allows our company to creates a mode of transaction acting as the mediator between the supplier and importer.

1.4 Ethiopian coffee cultivating and production regions

Ethiopia, widely acknowledged as the birthplace of coffee (to the chagrin of Yemen and Sudan, who have also laid claim), produces some of the most exceptional and dramatic coffees found anywhere in the world. From the bright bergamot and floral Yirgacheffe to the ripe fruit notes of Harrar, the unique flavours offered by this spectacular country have, over the last 10 years, become some of the most sought after in speciality coffee.

Only Arabica coffee is cultivated in Ethiopia, but the variety of individual cultivars – many as yet growing wild and undiscovered – is unrivalled anywhere in the world. Furthermore, the sheer volume of coffee produced dwarves the output of Kenya and Tanzania at around 450,000 tonnes annually.

Coffee probably began to be exported from the country as early as the 17th century, though trade didn’t become significant until the 19th century. Today, one can’t overstate the importance of coffee to the country’s economy. An estimated 15 million Ethiopians are employed by the coffee industry, and Ethiopia is hugely reliant of coffee as a major source of revenue: it accounts for close to 70% of all export earnings.

There are three coffee ‘production systems’ used in Ethiopia: Forest Coffees, where wild-grown coffee is harvested by the local population; Garden Coffees, grown in small holder plots (usually measured in terms of trees rather than hectares) along with other crops; and Plantation Coffees, a very small percentage of Ethiopian coffee, grown on large estates. The vast majority of coffee in the country is produced using the Garden Coffee system.

Coffee in Ethiopia was traditionally dry processed, but wet processing is increasingly becoming more common. 50 percent, or even more, of coffee in the country is wet processed now, which highlights the delicate, floral notes for which the country’s coffee is known.

Sidamo/Sidama

Sidamo or Sidama – covers a large area spreading through the fertile highlands south of Lake Awasa in the Rift Valley. It is made up of over 20 different administrative areas, or ‘woredas’, with varying microclimates and altitudes; accordingly, there is a big variety of both grades and cup profiles that end up labelled as Sidamo.

The Sidamo region (along with Harrar and Yirgacheffe) is one of three trademarked coffee regions in Ethiopia and is well known for having perfect climate conditions for coffee thanks to altitudes of between a 1,500 to 2,200 metres above sea level, ample rainfall, optimum temperature and fertile soil.

Around 60% of the region’s coffees are washed, though Sidamo also produces some excellent sun-dried coffees. There are upwards of 50 cooperatives in operation here, as well as many private buying stations – with over 200 washing stations around the various woredas.

Many thousands of bags marked ‘Sidamo’ are sold every year but there may be significant differences in cup quality. Merchants assesses many samples of Sidamo before we make any purchases. We are looking for a coffee which possesses a vibrant crisp acidity, with refined sweetness, floral and citrus notes and an elegant aftertaste.

Yirgacheffe

Yirgacheffe is part of the Sidamo region in southern Ethiopia, but its sometimes exquisite washed coffees are so well-known that is has been sub-divided into its own micro-region, which has been trademarked by the Ethiopian government. This steep, green area is both fertile and high – much of the coffee grows at 2,000 metres and above.

At first glance Yirgacheffe’s hills look thickly forested, but in fact it is a heavily populated region and the hills are dotted with many dwellings and villages’ growing ‘Garden Coffee’. There are approximately 26 cooperatives in the region, representing some 43,794 farmers and around 62,004 hectares of garden coffee. The production is predominantly washed, although a smaller amount of sundried coffees also come out of Yirgacheffe.

Harrar

The third of Ethiopia’s trademarked regional names; Harrar was one of the original ‘grades’ of Ethiopian coffee. In the 19th century, Harari coffee was known as being of highest quality (particularly compared to the ‘other’ available grade at the time, Abyssinia, which was simply wild-grown coffee from everywhere else in the country). Even today, the region is renowned for quality coffee and is highly desirable.

Today, Harrar coffees mostly hail from wild native trees on small farms in the Eastern part of the country, which are then dry-processed and traditionally classified as longberry (large), shortberry (smaller) or Mocha (peaberry).

Harrar flavours range from lots of blueberry through to a whole range of flavours, including banana, strawberry and bubblegum – some are even minty! These coffees are typically heavy-bodied and have a weighty mouthfeel.

The winy nature of this coffee means that it is not usually well-suited to drinking as a single origin coffee; therefore, Harrar is most commonly used in espresso blends to lend heady, fruity notes. It can be highly variable in preparation and, as a result, can be difficult to roast evenly. All part of the unique charm and appeal of this coffee!

Limu

The Limu region is less well-known than the ‘big three’ trademarked regions, but it is home to some excellent coffees. Limu coffee grows in the South-West of Ethiopia between 1,100 to 1,900 metres above sea level and is known and desired for its good cup, sweet, spicy/winey flavour and balanced body. Washed Limu coffee is considered one Ethiopia’s best highland-grown coffees. The bean is medium size, has a distinctive rounded shape and green colour.

Djima

This region, in the southwest of Ethiopia, is a large producer of Ethiopia’s coffee. Many coffees from this region are commercial grade.

2. Pulses

With its diverse natural resources and many agro ecological zones, Ethiopia is the homeland and domestication of several crop plants. Among those, large amounts of pulses have been farmed, consumed and exported for many years.

Types of pulses which Ethiopia produces & export to the globe are white Pea Beans, Small red kidney beans, Chickpea (Desi & Kabuli), Faba Beans (Horse beans), Soya Beans, Green Mung Beans, Dark Red Kidney Beans (DRKB), Pinto Beans, Light & Red Speckled beans, Bitter Lupin & many others.

Our company, Ethio Birhan, exports the following pulses types:

2.1 Common Beans

2.1.1 Common bean distribution in Ethiopia

Common bean in Ethiopia is produced in almost all the regional states with varying intensity. Production is concentrated in two regions: Oromiya and the Southern National Nationality Peoples region (SNNPR), which account for about 85 percent of the total national production. The remaining 25 percent comes from Afar, Amhara, Tigray, Somali, Gambella and Benishangul-Gumuz.

2.1.2 Groups of common beans

There are two types of common beans in Ethiopia, white canning and coloured food type, are grown. The white beans dominate in the Oromiya region (Northeast rift valley), where more than 95 percent of farmers grow it and account for about 50 percent of total common bean production. On the other hand, the coloured bean type dominates SNNPR, south of Lake Ziway. Farmers in Oromiya prefer white bean because of its earliness, which makes it suitable as a safety crop during the months of October and November when other crops are still in the field and not yet mature to provide food. However, area under the white beans depends on rainfall patterns. When rains come late, the risk of growing maize increases and farmers replace maize with beans, implying that the area under white beans is likely to be higher when there is rainfall failure in Ethiopia.

On the other hand, colored food types are preferred in SNNPR because of their popularity in the local diet and relatively lower production costs compared to white beans. White beans require additional labour for field preparation, keeping away birds as well as purchase seed at planting time. The varieties within the coloured bean type include the reds, white and black, but the reds are the most important. About 80-90 percent of the area allocated to common bean in SNNPR is designated for red varieties while the white varieties occupy10-20 percent of the area.

The other not too common type of bean in Ethiopia is the Haricot bean which is an important pulse crop. The crop ranks first globally while it stands second next to faba bean in the country. The major haricot bean producing regions include Oromia, Amhara and Southern Nations Nationalities and Peoples Region (SNNPR). Their share to the national haricot bean production is 51% for Oromia, 24 % for Amhara and 21% for SNNPR.

Haricot bean is the most important pulse crop in the SNNPR. It is grown both as sole crop and in association with other crops. Though it is produced in most parts of the southern region, the leading zones of production are Sidama, Wolayita and Gamo Gofa.

The nutritional composition of haricot bean contributes greatly towards a balanced and healthy diet. This is because the grain has high protein content and good micro-nutrient concentration. As some people say it is considered as ‘a poor man’s meat’ because of its high protein content. Moreover, their amino acid composition is useful to complement the amino acid profile of cereal proteins. Thus, haricot bean is an important crop in addressing the issue of nutrition security in southern Ethiopia where people’s diet is dominated with maize, root and tuber crops.

2.2 Mung bean

Mung bean is one of the most important pulse crops, grown from the tropical to sub-tropical areas around the world. It is an important wide spreading, herbaceous and annual legume pulse crop cultivated mostly by traditional famers. The crop is characterized by fast growth under warm conditions, low water requirement and excellent soil fertility enhancement via nitrogen fixation.

Fertilization of this crop occurs through self-pollination without requirement of other pollinators like insects, water and wind. Among legumes, mung bean is noted for its protein and lysine-rich grain, which supplements cereal-based diets. The crop is utilized in several ways; seeds, sprouts and young pods are all consumed and provide a rich source of amino acids, vitamins and minerals. The grain contains 24.2% protein, 1.3 % fat and 60.4 % carbohydrate. It is also known to be very healthy and packed with a variety of nutrients such as vitamin B, vitamin C, protein, manganese and a lot of other essential nutrients required for effective functioning of the human health. Mungbean has low in calories and rich in fiber and easily digestible crop without cause flatulence as happens with many other legumes.

Mungbean has good potential for crop rotation system, for crops under drier farmland cultivation areas and ability of growing on dry and irrigated conditions. Sowing of mungbean mainly occurs during summer when sufficient rain is available for growth but it is sensitive to waterlogging. It is grown in several types of cultivation systems, including sole cropping, intercropping, multiple cropping and relay cropping, where it is planted after cereals using residual moisture.

In Ethiopia mungbean is mostly grown by smallholder farmers under drier marginal environmental condition and the production capacity is lower than other pulse crops. For resource poor farmers in Ethiopia, mungbean is mainly used as food, but growing it for income generation can also be important. The varieties used for income generation may be different than those which can give a stable yield under harsh environmental conditions. Result from farming practice used as food, medicine, economic, ecological, socio-cultural, 3 religious and cultural needs. Mungbean is cultivated for its edible seeds, income generation and fodder for livestock’s.

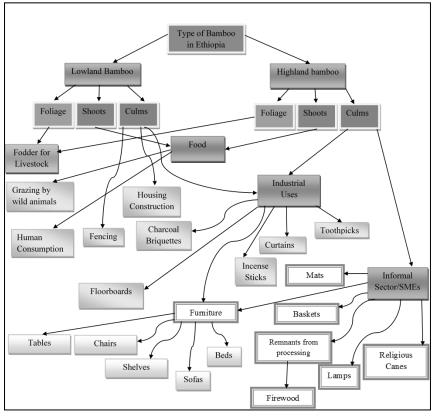

2.3 Bamboo

Bamboo is one of the more important natural resources in Ethiopia and contributes to the bio economy as a potential source for high-value products. While the country is the largest producer of bamboo in Africa, the existing utilization of the bamboo sector in Ethiopia remains under-developed, with little value addition. This study identifies the current market challenges and opportunities for future developments of the northern Ethiopian bamboo sector, with a focus on the Injibara Township. This research adopts the “value web” approach to assess the potentials of different product lines that create the bamboo biomass value web. We utilize qualitative data collection methods, in particular, semi-structured interviews and informal focus group discussions with key stakeholders. Our findings suggest that bamboo farmers in Injibara are constrained by a lack of local demand and market for bamboo products with high-value addition, leading to an absence of product diversification and innovation. Furthermore, there is an overreliance on foreign technology and methods that are poorly matched for local needs. We recommend that policymakers invest in targeted and effective training strategies on bamboo cultivation and processing. Furthermore, farmers can benefit from decreasing their reliance on middle men with cooperatives or contract arrangements.

Bamboo products are seen as inferior by the Ethiopian society in general. This is partly exacerbated by the problem of the in appropriate storage of bamboo culms. For products with high value and labor addition, people are unwilling to pay a higher premium. This brings up an important point that skill training has little effect when there is a very minimal demand and market for more expensive bamboo products. Because of these types of challenges, there is no incentive for local small processors to innovate new bamboo products for the market. For example, we asked why locals do not produce kitchen utensils out of bamboo, as many Asian countries do. The response was that it simply is not in their culture to do so, and no one has ever thought about it (Production Employee, private firm). The absence of a proper market leads to a lack of incentives to innovate. One of the biggest differences that has been found in terms of pricing of bamboo products is the location of the products being sold. As shown in the results section, the same bamboo bench sold in the city of Bahir Dar can bring in twice as much as income as a bench sold on the roadside of Injibara.

The high value-added furniture is sold at a high markup price because they have access to the expatriate market in Addis Ababa. As foreigners tend to prefer bamboo products more than the local population, it will be interesting to see how the bamboo market will be altered as the expat community grows in Addis Ababa. Another factor is related to the seasonal variability’s in bamboo cultivation, process, and trade. First, because bamboo requires additional time for drying during the rainy season, space becomes a big issue for small processors as they have limited space for storing excess culms. Demand for bamboo products decreases in the rainy season while the price of raw bamboo culms increases. Theoretically, an increase in raw culm price should benefit the bamboo farmers. However, harvest is much more difficult in the rainy season, and several farmers also remarked that they do not cut bamboo during the rainy season. At the same time, the increase in culm pricing strains the small handicraft sectors. For families, whose entire livelihood largely depends on bamboo, the rainy season becomes especially difficult for them. It is also a major constraint there are no factories set up in places where bamboos are cultivated and harvested. It is currently difficult to set up factories near bamboo forests. Problems, such as a lack of electricity and inconvenience for factory owners, make it unappealing to have an operation on site. In addition, there is a lack of policy support for the investments of these purposes. If bamboo factories were actually set up near the resources, then this would cut out the middlemen problem, with possibly more income going directly to the farmers. Factories would also have more capacities to store and dry the bamboo culms after harvest.

There is a clear lack of diverse bamboo products on the market. In Injibara, identical products are being produced in clusters. The same types of products that require similar skills are produced in the same area. For example, on the same road that stretches for many kilometers, mats are the only products available. Once in a while, craftsmen receive special product orders from customers. For the most part, traders come and collect the mats to be sold in other markets and cities. Because smaller processors have no means of transporting the finished mats elsewhere, they depend on the traders to provide them with their source of income. If traders do not come to collect the mats, then they have limited access to other means of selling or they do not sell at all. Since everyone is producing the same product, the middlemen have much more bargaining power to negotiate lower prices.

This study focused on the current utilization and future potential of the bamboo market in Injibara, Ethiopia, within the framework of the biomass value web in the forthcoming bio economy. As our research suggests, there is a set of complex and multifaceted hindrances that has kept the market for bamboo in northern Ethiopia under-developed, despite the many efforts that have been made in the last decade. There have been some improvements and signs for a positive outlook in the future. For local consumers, there is a general lack of demand and market for products with high-value addition. This is due to the mindset that bamboo products are of low quality. The phenomenon is further exacerbated by the lack of proper cultivation and management. The value-addition training given by governmental and international organizations has been ineffective.

There is neither a sufficient demand nor market for more sophisticated bamboo products. Therefore, the effects of value addition training are minimal. Furthermore, the majority of the given training requires the use of large and expensive machinery that smallholders simply do not own nor have access to. If processors have the skills, but no tools to utilize the given knowledge, then the training given is of little use and value. Finally, there are no established means of bamboo marketing. Other than through word of mouth, government bazaars and such, small bamboo processors have limited access to the market both in the promotion and the transportation of the finished products. Further research in the bamboo sector to fill a wide knowledge gap is needed. There is currently very little research and literature that exist in the bamboo sector in Ethiopia.

As the findings and analyses in this study demonstrated, the untapped potential of the bamboo biomass is a multi-faceted and complicated problem. The development of the bamboo sector needs to be a holistic approach. The outlook for the future to develop the sector needs to be a long-term investment with an emphasis on every stage, from propagation to production. By far the most difficult aspect would be to educate and have people accept knowledge that they did not know for most of their lives. However, with enough interest and motivation to commit long-term to this development, there is no reason why the bamboo sector cannot develop as a major contribution to the bio economy.

Ethiopia has an estimated sum of one million hectares of natural bamboo forest, 7% of the world total and 67% of the African total, hence, the largest in the African continent. Despite the veritable resource base and advanced bamboo utilization at a global scale, its great potential to enhance socio-economic and ecological development remains unrealized in Ethiopia.

Bamboo utilization in Ethiopia is basically rudimentary, and bamboo product import exceeds export, in contrast to the resource base of the country. Bamboo is becoming increasingly important in the world since:

- it is a superior wood substitute;

- it is cheap, efficient, and fast growing;

- it has high potential for environmental protection;

- it has wide ecological adaptation; and

- The state of forest is shrinking globally. Ethiopia is one of the few countries in the world endowed with a vast bamboo resource base.

The two indigenous bamboo species in Ethiopia are the African alpine bamboo, and a monotypic genus of lowland bamboo. Natural bamboo forests grow in various regions in Ethiopia. Northwestern, western, southern, and central part of the country, ( AsoX/Bambasi, Bahirdar/Banja, Chencha, Hula, Tikur Enchini, Masha) (source: Ethno botany research & applications)

Ethio Birhan trading is one of the few companies engaged in manufacturing of bamboo products in Ethiopia. The PLC is established on with an initial capital of birr 933,721.78 and has already engaged in exporting bamboo product to different countries.

Ethio Birhan trading is expected to substitute import, create employment opportunity and ultimately can generate foreign exchange through exporting of manufactured goods to the international market.

Socio-economically, the project assumes to generate income for the owner, for the 14 workers plans to hire and it also creates income for the government in the form of tax. The project, as was confirmed by the concerned office is environmentally friendly.

The team has made analysis of the feasibility study of the promoter, the internet as well as tangible situation of the market to determine the current and future demand and supply conditions of the specific products with their respective prices. Therefore, based on our analysis, the market for bamboo products is found to be promising.

Summary of the project investment

| Investment items | Amount | Percentage |

| Fixed Investment | 30,627,961 | 62.52% |

| Working Capital | 18,362,127 | 37.48% |

| Total | 48,990,088 | 100% |

Source of finance

| Description | Amount | D/E Ratio |

| Debt- FINANCER Bank Loan | 19,867,056 | 41% |

| Equity Contribution | 29,123,032 | 59% |

| Total | 48,990,088 | 100% |

Loan cost allocation

| Description | Amount | D/E Ratio |

| Debt- FINANCER Bank Loan | 19,867,056 | 80% |

| Equity Contribution | 4,966,764 | 20% |

| Expected Financial Results |

| Description |

| X Revenue |

| Profit (Loss) |

| Cumulative Cash Balance |

| FIRR before Tax = |

| FIRR after Tax = |

| Sensitivity Analysis | ||

| Description | FIRR Before Tax | FIRR after Tax |

| When Revenue decreased By 10% | 37% | 22% |

| When Operating Costs increased By 10% | 43% | 27% |

| When Investment Costs increased By 10% | 60% | 45% |

| Net present value | ||

| Description | Net Present Value (NPV) | |

| Before Tax | 183,796,363 | |

| After Tax | 130,377,415 |

2.4 Sesame seeds

Domestic Scenario: Ethiopia is known to be the center or origin and diversity for cultivated sesame. Sesame seed is one of the oilseed crops grown in Ethiopia. Sesame (Sesamum indicum L.) is one of the oldest cultivated plants in the world. Today, India and China are the world’s largest producers of sesame, followed by Burma, Sudan, Mexico, Nigeria, Venezuela, Turkey, Uganda and Ethiopia.

Product Varieties: The improved varieties of sesame seen in use in the country include Adi, Abasena, Qelfo 74, Mehado-80, Argene, Terkamo, E, S, T-85 and Tate.

Agro-Ecological Conditions: The growth of sesame is indeterminant, as the plant continues to produce leaves and flowers so longs as the weather permits. Weighing roughly one ounce each, seeds of lighter colors are considered of higher quality. Sesame is drought tolerant though not tolerant of water logging.

While it has the potential to grow in different parts of the country, sesame grows mainly in the northern and northwestern regions of Ethiopia (Humera and Wellega). For areas with shorter rainy season periods, the planting period should fall immediately after the onset of the rainy period (June to mid-September). The planting period for areas with longer rainy seasons (late May to October) the planting period should fall in the middle of that period, during which the farmer can benefit from both the rain and sun. Additionally, sesame seed can grow well in lowland/humid areas with altitudes of up to 1,250m with preferred rainfall of 500-800mm.

Domestic Production: In 2005/06, Ethiopia’s volume of main season sesame seed production was .16 million tons. During the same year, sesame seed accounted for 1.2 % of major crops production (including oilseeds and pulses). For the period, 1998/99-2005/06, main season production of sesame seed, on average, accounted for 0.5% of total national major crop production that includes cereals, pulses and oilseeds. In the last five years, the main season yield of sesame seed has reached a high of .89 tons per hectare.

Commercialization: Crop utilization survey data shows that, of the total national production of sesame seed, 32.31% was utilized for household consumption, 57.66% for sale; while the balance was used for seed, wage in kind, and animal feed.

In general, research result shows that, excluding the volume of grain set aside for consumption, seed and feed, 28% of total grain production (including oilseeds and pulses) is marketed, of which 40% is accounted for by oil seed crops in general.

Global Scenario: Ethiopia is a major sesame seed exporter in the world market. In 2005/06 Ethiopia exported 237, 565 tons valued at about 197.9 million USD (84 million Birr), accounting for roughly 94% of the total export earning from oilseeds and 19% of total national export earning. This increase in global demand has turned the highly domestic consumption item into an important export commodity. The world production of sesame seed, in 2004, reached 3.3 million tons in 2004, with world exports totaling 802,063 /valued at 650 million USD/ and volume of world imports reaching 903,368 tons /valued at 846 million USD/.

Prices: Sesame seed wholesale prices exhibited high intra and inter year variations during 2004-2006, reflecting domestic supply and the periodic trends of the global sesame seed demand and supply situations. For instance, available intra-year wholesale price variation /highest and lowest/ for the Gonder market in 2005 was 17%.

Payment strategies

Ordering & Payment Procedures:

What are the ordering procedures?

- Contact In order to get our service

- Selection of services our web page, features various products available and our services. The customers can also search the product description and warranty we provide. They can be updated with services we provide through our web page. The customers can select the types of the service they want.

- Pricing of the services will be available in both Ethiopian birr and dollar. For convenience customer can directly contact in our office.

Our company Ethio birhan has appropriate and different options for our customer’s payment methods for the solar power system installation.

- The customers have to pay 50% of the project cost before the project has started and will complete the whole left payment after the completion of the work or

- The customers have to pay 50% of the project cost before the project has started and the clients are expected to pay only 30% of the remaining after the completion of the project. Then the 20% of the last payment will be completed within 12 months after the final test of project.

Business strategies

Desired Image and Position in the Market

We have providing stand out in the solar market through our service and product reliability. We want to be the customer’s first choice by creating positive public image through different media. We want to create an image of a company which provides green energy at cheap and easy installment facility.

SWOT Analysis

SWOT Analysis for SEC is done as follows:

- Strength

- Good quality of service

- Strong public relationship

- Highly skilled manpower

- Understanding and Unity among the partners

- Strong relation with the manufacturers

2. Weakness

- Inexperience

- Inadequate information about customer’s needs

3. Opportunities

- Load shedding

- Target customer are unsatisfied with current available services

- Promotion of renewable energy from government level

- Subsidies and tax credit on the solar products

4. Threats

- Political instability

- Existing competitors

Competitive Strategy

The type of strategy we employ to create a market share for our company is focus strategy. We will focus on the class of people who need electricity for their daily works, the class of people who are having a really hard time to deal with the current load shedding problems. To attract such customers we will engage in advertisement campaigns which will educate people to use green solar energy, campaigns which will explain the long term benefits of using our systems than using generators.

Advertising and Promotion

The advertisement is depending upon the target customers; where are they? How should we communicate with them? Ethio birhan is going to answer these questions with the effective advertisement and promotion techniques. This section includes a description of all advertising means and medium we are planning to use as well as public relations program and promotional materials (such as brochures).

We will use following media for advertisement:

Media we are planning to use are two types of Advertisement, Offline and Online advertisement. We mainly focused on offline than online advertisement.

Offline Promotion

Newspaper: is a good source of communicating with the potential customers, especially of age group 20- 40 years. Our targeted customers prefer the newspaper written in different regional languages. As our allocation of cost for offline advertisement is high, the advertisement will be weekly or may be monthly.

Magazines: Another effective means of advertising for our company is magazines which has wide reach to the target customer. Magazines offer long life span resulting in good chance of being seen several times.

Brochure: Our Company publishes a brochure annually including all the activities of the company. Brochure helps to make customer up to date about income and expenses of the company. The report of seminars and interaction programs held in the year is published in it. A strong brochure can be the back bone to reflect the positive feedback from customer for an institution. So we are planning to invest enough capital to publish own brochure.

Billboards

Online Advertising

Internet

- YouTube

- Website ….

Public Relation

To increase public relation, we will organize program to create awareness about alternative energy. This type of program will help to raise our company status in public perspective and different media covering the program will help recognition of our company existence. This will also help to make relationship with different professional and expertise of different fields.

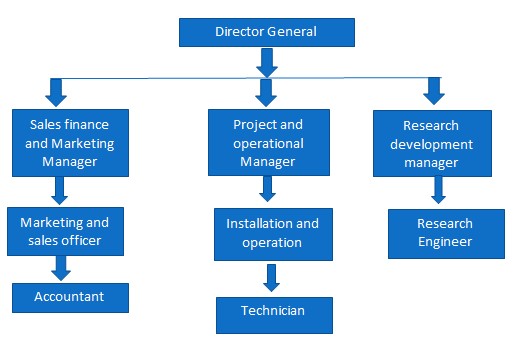

Description of management team

Ethio birhan trading is an organization which is owned and managed by Ato Moges Fekadu

Ethio birhan will operate with four departments

- Research and Development Department

- Installation and Operation Department

- Sales , Marketing Department and Finance Department

The employers and employee are responsible for one department and they will make the decisions on their respective department and the major decisions of the company will be jointly discussed.

Structure of the company

Financial plan

The initial investment requirement for the projected business plan is started with $600,000 the source of fund was from owners’ equity which accounts 25% of the investment cost or USD 150,000 and 75% is from the load which is USD 450,000. The loan received is expected to be repaid quarterly basis within two consecutive years.

Completed Projects

- 3Kw Resident solar power installation

The solar power installation of 3kw is completed successfully, and tested well. And our customers were excited when the power their start to drives the loads .

Conclusion

The business plan of Ethio birhan trading Solar Energy Company Implemented in Ethiopia. We are very confident that our business will reap lots of benefits economically as well as socially in the country.. The company is providing lots of facilities and services regarding solar technology. It mainly focus on the customer satisfaction and need. It solved the problems of energy crisis, load shedding and backup systems in the various sectors like banks, offices, hospitals, houses, etc. The SWOT analysis and Strength and Weakness analysis of competitors has been properly done to mitigate the risk.

Recent Comments